Did you know federal student loans could become part of your financial aid offer when you complete the Free Application for Federal Student Aid (FAFSA)? Want to know more? We’ve compiled a Federal Student Loans Guide just for you! Read on for the answers to some of the most important loan-related questions you could ask.

What Types of Loans Could I Qualify for with FAFSA?

Direct Subsidized Loan

This is a need-based loan only for undergraduate students. Submitting a FAFSA does not guarantee that you’ll be eligible for this type of loan. Interest does not accrue on subsidized loans while you’re enrolled in at least six credit hours necessary for your degree program.

Direct Unsubsidized Loan

This is a non-need-based loan that all students that are eligible to file a FAFSA can qualify for. Interest accrues on an unsubsidized loan upon disbursement. The interest rates can change from one aid year to the next.

How Much Student Loan Money Can I Borrow?

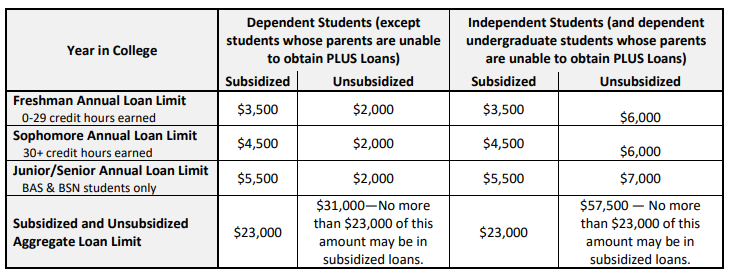

This is a great question! Your loan offer could comprise both subsidized and unsubsidized loans. The maximum amount you can borrow as a dependent Freshman is $5,500 for the year. However, we want you to know that you don’t have to borrow that full amount if you don’t need it. It’s important to note that if you borrow any unsubsidized loan money, you’ll end up paying back more than what you borrowed because this type of loan accrues interest.

The chart below breaks down the annual loan amount that students can borrow based on grade level and dependency status. Additionally, the bottom of the chart shows aggregate loan limits—the maximum amount you can borrow while an undergraduate student.

When Do I Have To Pay My Federal Student Loan Back?

If you fall below part-time enrollment or graduate, you’ll have a six-month grace period before your loan repayment period begins. If you return to part-time enrollment before the six-month grace period ends, you can have your loan repayment deferred (postponed).

How Do I Use My Student Loans To Pay My Tuition?

First, you’ll need to submit a FAFSA online or on your smartphone using the myStudentAid app (available for iOS and Android). You’ll also need to ensure you’re enrolled in at least six credit hours (part-time) for your degree program at EFSC.

Next, you’ll need to monitor your Titan student email account for your financial aid award offer notification. When you receive it, log in to myEFSC to accept your student loan in full. Alternatively, you can choose to accept a smaller portion of your offered loan. Should you choose to accept a smaller amount, you can always accept the remaining loan amount later.

Finally, you’ll need to complete Loan Entrance Counseling, which goes over your rights and responsibilities as a borrower. You’ll also complete a Loan Agreement or Master Promissory Note. This is your legally binding contract as a student loan borrower with the federal government. You can complete both items online.

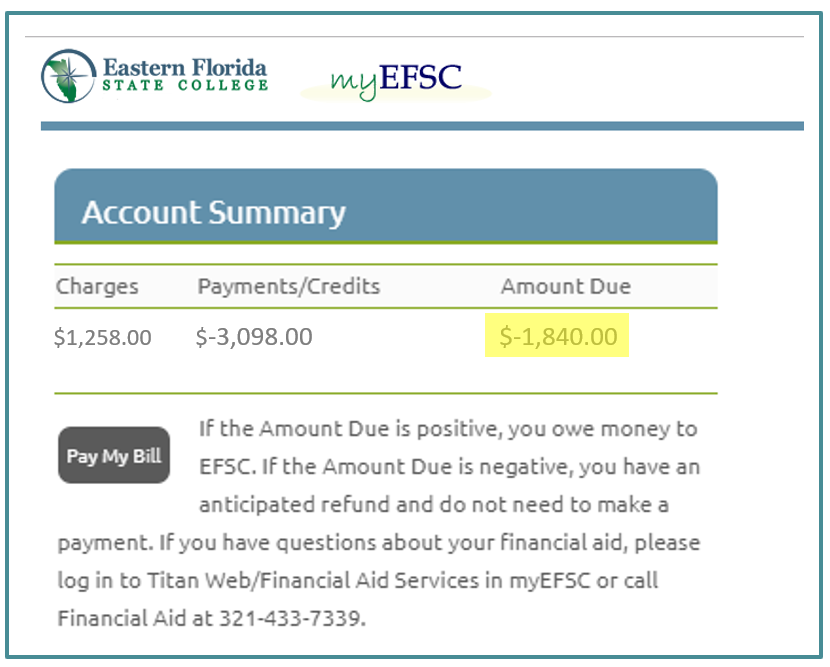

Be sure that you accept your student loan and complete all of the aforementioned steps in advance of the Fee Due Date. Once you do, you’ll also be able to see your federal student loan as a credit/payment in the Account Summary section of your myEFSC portal, where it’ll be displayed as a negative number:

What Else Should I Know as a Federal Student Loan Borrower?

Disbursements for First-Time Borrowers

As a first-time federal student loan borrower, your loan will disburse 30 days after the start of the term, provided your attendance can be confirmed for part-time enrollment. If you won’t begin part-time enrollment until a later part of the term, your loans will not disburse until 30 days after the start of that later part of term. Here’s an example:

If you are taking two three-credit hour classes that start the week of May 17th, your federal student loan will disburse on June 16th. But if you are taking one three-credit hour class that starts on May 17th, and your other three-credit hour class doesn’t start until June 28th, your federal student loan will not disburse until July 14th, after you have started that later class. Review EFSC’s upcoming financial aid disbursement dates to learn more.

Satisfactory Academic Progress

In order to maintain your eligibility to borrow federal student loans, you need to ensure that you maintain Satisfactory Academic Progress (SAP). These are the federal standards that students must meet in order to renew their eligibility for federal student aid. The minimum standards are a 2.0 cumulative GPA, a completion ratio of 67%, and completion of your degree within 150% of the hours it requires.

If you don’t meet these standards, you may be suspended from receiving federal financial aid; however, there is an appeal process for students with extenuating circumstances. Read more about SAP.

Course Withdrawal Impacts

If you need to withdraw from your classes (or if you stop attending all of your classes), you may have to return a portion of the federal loan that was disbursed to you. This is called the Return of Title IV. If you’re not withdrawing from all classes and choose to remain in other classes that are necessary for your degree, you won’t have to return any of your loan until your regularly scheduled repayment rolls around (after you graduate, or if you fall below part-time enrollment). In either situation, know that withdrawing from classes can also negatively impact your completion ratio for Satisfactory Academic Progress.

How Can I Keep Track of My Student Loan Debt?

To keep track of your student loan debt amount or to find additional information about your student loans, you can log into the Student Aid website with your FSA ID and password — the same ID and password you used to sign your FAFSA. You’ll then be able to monitor your student loans directly from your dashboard.

Important Tip From a Previous Student Loan Borrower

Borrow only what you need to pay for your tuition, fees, and other related educational expenses. Always keep in mind that this is borrowed money, and at some point, you will have to repay it. Some words of wisdom I’d like to pass on that I wish someone had said to me when I was a student: just be a smart borrower!

If you have questions about borrowing loans, we have financial aid specialists available to help you get the answers you’re looking for. Reach out to finaid@easternflorida.edu from your Titan student email account, or call us at 321-433-7339.

- Your StudentAid.gov Dashboard - October 20, 2021

- Yes, You Can Use Your Financial Aid To Buy Books! - June 2, 2021

- Thinking About Borrowing a Federal Student Loan? - March 31, 2021